REFRAMING SPENDING AND INVESTING

Islam aims to avoid extreme stinginess or excessive spending on oneself. In describing the righteous believers, Allah says in the Qur’an, “And [they are] those who, when they spend, do so not excessively or sparingly but are ever, between that, justly moderate.”(Qur’an 25:67) The Prophet صلى الله عليه وسلم also said, “Eat, drink, give in charity, and wear nice clothing, but without pride and extravagance. Verily, Allah loves for His blessings to be seen upon His servants.” (Musnad Aḥmad, no. 6656.)These texts demonstrate that moderation in all forms of spending is optimal. However, as many of life’s expenditures pertain to one’s family, Islam reframes spending on family as a type of charity when done with the intention of pleasing Allah. The Prophetصلى الله عليه وسلمsaid, “If a Muslim spends on his family seeking reward from Allah, it is charity for him.” (Ṣaḥīḥ al-Bukhārī, no. 5351; Ṣaḥīḥ Muslim, no. 1002) In addition to understanding how to spend money moderately, Islamic psychoeconomic guidance reframes the meaning of investing.

Investing refers to a method of allocating wealth into assets that one expects to profit from. The objective of investing is to reap the rewards of one’s investments in the future. Ethical investing ( By ethical investing, I refer to investments that are in accordance with Islamic law. For example, investments that are interest-based or involve the development and sale of forbidden products are to be avoided.) is encouraged in Islam, as the individual benefits by having their wealth grow and society benefits as the economy grows through successful investments. ʿUmar ibn Khaṭṭāb advised, “Invest the wealth of orphans so that it will not be eaten away by zakah. ”(Mālik, Muwaṭṭāʾ, no. 592.) This statement establishes that money 33 lying around will decrease due to the obligation of zakah. If a person had $10,000, it would become $9,750 after paying 2.5% in zakah ($250) at the end of the year. After 10 years, the original $10,000 would be worth just under $8,000. Thus, paying zakah should encourage investing, as money not being invested is effectively subject to a negative interest rate of -2.5% (this is only referring to interest from a purely financial perspective, not from an Islamic legal or spiritual perspective).

Although there is great reward and barakah in zakah, the Prophetصلى الله عليه وسلمnonetheless encouraged us to invest our wealth. Through putting our wealth in halal investments, we increase the likelihood of increasing our wealth and subsequently giving more. Although Islam encourages worldly investing in order to safeguard and grow wealth, it fundamentally reframes what types of investments are worth focusing on. The following aḥādīth demonstrates how the Prophet reframed investing. He said, “… The son of Ādam boasts, ‘My wealth! My wealth!’ O son of Adam, have you truly earned any wealth but that you ate and consumed, or put on and wore out, or spent in charity so it remained?” (Ṣaḥīḥ Muslim, no. 2958.) In this narration, from a religious perspective, the only wealth that one retains is that which is invested in charity. In another narration, he said, “Who among you considers the wealth of his heirs dearer to him than his own wealth?” They replied, “O Allah’s Messenger! There is none among us but loves his own wealth more.” The Prophet said, “So his wealth is whatever he puts forth [in charity] during his life, whereas the wealth of his heirs is whatever he leaves after his death.” (Ṣaḥīḥ al-Bukhārī, no. 6442.) Again, the Prophet is reframing what constitutes true wealth by encouraging investing in charity as a way to build one’s spiritual net worth and nest egg for the afterlife. In yet another narration, it was reported that ʿĀʾishah had a sheep slaughtered. When the Prophet found out, he inquired about it. He said to her, “What remains of it?” She said, “Nothing remains of it except its shoulder.” He said, “All of it remains except its shoulder.” (Sunan al-Tirmidhī, no. 2470.) Thus, the Prophet explicitly reframed ʿĀʾishah’s worldview of wealth. Rather than interpret what has been given away as ceasing to be in one’s possession, what has been given away should be seen as an investment that one retains. All of these narrations reinforce the same principle in different contexts, highlighting the consistency of this Prophetic investing principle. Therefore, if we return to the definition of investing as a method of allocating wealth into assets that one expects to profit from in the future, there can be no greater investment in one’s future, in this life and the afterlife (ākhirah), than philanthropy and charitable giving. Similarly, just as investing in our personal dunyā portfolio is important and has best practices, investing in our personal ākhirah portfolio also has best practices to be mindful of. Here are a few suggestions:

1. Invest in your ākhirah portfolio as early as possible and consistently. Charity grows at an exponential rate. (Qur’an 2:261) Investing in one’s ākhirah from a young age disciplines the soul, builds trust in Allah, and the returns in the afterlife will be greater than if one began investing in their ākhirah portfolio later in life. Additionally, regularly contributing ensures that one’s ākhirah investment steadily grows over time. Set aside a percentage of your income or a fixed amount for weekly or monthly investments.

2. Take calculated risks and invest when others are hesitant. Just as risk tolerance is a consideration in worldly investments, it is recommended to invest in projects that have tremendous potential. The Qur’an alludes to this when praising those who donated to Islam during its most vulnerable times before the conquest of Makkah as being superior to those who donated after the Islamic state was powerful and solidified.(Qur’an 57:10) The reward is greater in the 38 early phases of a righteous project.

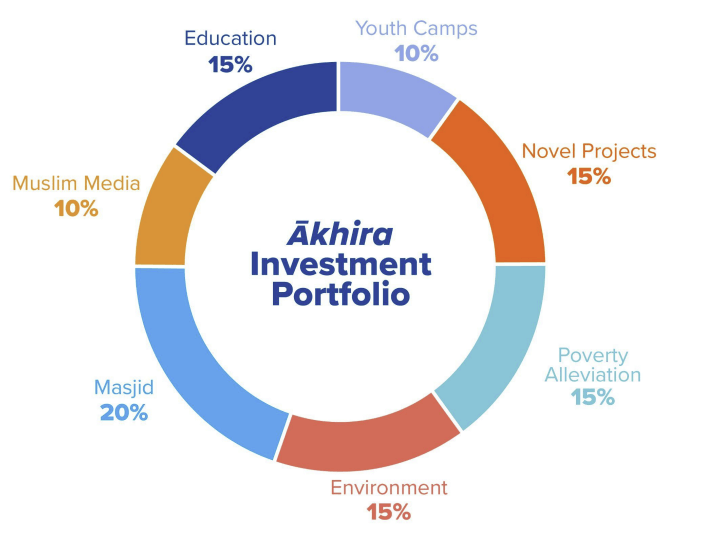

3. Diversify your ākhirah portfolio. Building off the last recommendation, it is important to invest in a variety of causes. Although people have preferences for certain projects, they should still invest in a variety of righteous causes, including masājid, schools, poverty relief, education, social issues, and more. This ensures the person reaps a return on investment from each noble cause.

Figure 1. Hypothetical diversified ākhirah investment portfolio

Despite the tremendous reward in investing in one’s ākhirah, there may be psychological barriers to committing to a life of philanthropic investing. We discuss a few of these in light of the Qur’an, Sunnah, and modern science.

By Osman Umarji

Comments

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.