ISSUES OF ISLAMIC EQUITY INVESTMENT

STELLA COX

The development of Islamically structured equity funds has been a favored focus of the last couple of years and has indeed resulted in the launch of various products by a number of Islamic and conventional institutions working both independently and in partnership.

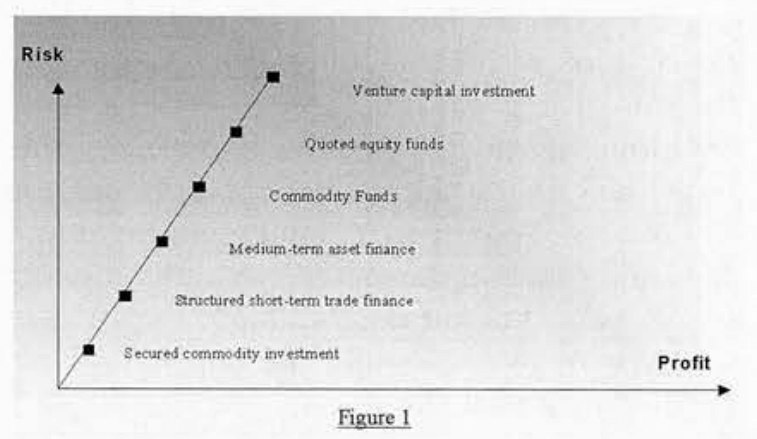

Until recently, much of the product innovation for the Islamic financial sector had been targeted at the Islamic commercial banks and engineered with regard to their specific investment risk and return criteria. The result was the development of a variety of financing techniques; initially short-term, secured commodity and trade finance offering low risk and return and, latterly, structured medium-term investments in trade and leased assets that moved up the risk and return curve.

Although these innovations have assisted with the expansion of the product base, there has, without doubt, been a dearth of appropriate investment opportunities available to those investors seeking potential for enhanced profits and added portfolio diversification.

Construction of a balanced portfolio requires access to a range of asset categories and investment horizons. Past research by numerous authorities suggests that a well-diversified portfolio of global stocks will outperform other asset categories (for example cash and bonds in the conventional markets) over the medium term – owing to the inherent volatility of the equity markets, a medium-term view is a prerequisite.

Figure 1 illustrates portfolio opportunities for an Islamic investor. It moves along the risk curve from the lower-risk, lower-return investment, that has previously been a feature of the market, to higher-risk assets that are potentially more profitable and likely to satisfy the investor’s total yield aspirations. Towards the top of the curve, asset allocation shifts to open-ended equity funds and closed-ended venture capital or private equity investment opportunities.

Global Equity Investment – The Early Islamic Funds

The drive towards enhanced yield (whilst still retaining access to liquidity) has led to the renewed prominence of Islamic equity funds. These followed the first wave of Islamic equity investment products launched by Kleinwort Benson Investment Management (KBIM) and UBS in the mid-1980s.

KB’s product was somewhat unimaginatively titled “The Islamic Fund”. It was a unitised Guernsey-registered fund that bore the endorsement of its own Sharia Advisors and was created to offer our institutional and high-net-worth private clients asset diversification.

These funds were sometimes referred to as commercially unviable; However, despite screening individual stocks in accordance with the stipulations of our Sharia Board, we were still able to amass a substantial global universe that regularly outperformed its MSCI Index benchmark. At its height, our fund’s managers were responsible for over US$20 million – small in conventional terms, but certainly viable.

However, we had critical, structural and distribution issues to address. For example, at the time, there was only limited endorsement of global equity investment amongst the individual Sharia authorities. Acceptability of international equity as a Halal investment was rigorously debated, which certainly limited the scope of market potential and meant that we were unable to enlist the support of an Islamic institutional partner.

Nevertheless, the Gulf Bank in Kuwait was keen to sell the product to its own customer base and, owing to the long-standing relationship that already existed between our two organisations, it was a very successful union. We were able to attract our own private clients, whilst Gulf Bank delivered the product through its retail network.

Without a doubt the Islamic fund was best received in Kuwait and we became exposed to that market when distribution was less effective elsewhere. The Gulf crisis led to rapid redemption of many shares and our belief was that the remaining funds under management could not be effectively diversified across market sectors to produce optimum performance for the remaining shareholders.

When we wound down the Fund in 1991, we retained a number of client investments as independently managed portfolios and subsequently substantially increased aggregate funds under management. Perhaps the main advantage of this for us has been that we are able to address and satisfy)’ the varying Sharia, sectoral and performance stipulations of individual customers, although this client-specific approach requires considerable allocation of time and resources.

Islamic Equity Funds: Product of the 1990s

After the initial forays into global equity investment, the market remained fairly quiet until the end of 1994, when the AI Madina Equity Fund was launched and managed by Albert E Sharp and Faldo Hassard. This was followed by the National Commercial Bank Global Equity Fund launched in January 1995 and managed by the US-based Wellington Management Company.

In Autumn of 1995, The International Investor (TII) of Kuwait launched the Dublinregistered Ibn Majid Emerging Markets Equity Fund, simultaneously announcing that it would be managed by the Swiss Bank Corp, with whom TII intended to develop further equity funds. There were a number of interesting and innovative features about this investment product.

i) It was, for example, the first time that a Middle Eastern institution operating within the Islamic Sharia had actively attached its brand to its own equity fund and launched it;

ii) With an emerging market focus it diversified from global equity and addressed a specific sector; and

iii) It brought together a prominent Islamic investment company with a major Western bank, blending joint structuring skills with Sharia credibility, fund management capability and global distribution.

Banque Indosuez also chose to focus on emerging markets with Ibn Battutah, which it managed in-house. In 1996, Flemings launched the Oasis Global Equity Fund and Banque Nadonale de Paris its Caravan Fund (also managed by Wellington). Both added to the group of conventional banks able to address previous criticism that Western institutions were reluctant to commit funds and resources to developing innovative, or previously untested, products for the Islamic market.

The year 1996 also saw the launch of AI Safwa Global Equity sponsored by AI-Tawfeek Company for Investment Funds (managed by Roll and Ross Asset Management) and the launch of Faisal Finance’s SE Asian equity-focused Adil Fund.

These (and a number of other) recent funds have all been launched with the endorsement of their own Sharia supervisory committees, although it is fair to say that we have yet to achieve unanimous Sharia approval for equity investment in interest-based financial markets. So, what has changed to persuade an increasing number of financial institutions to launch Islamic equity products?

It is reasonable to surmise that much of the change is being directly spearheaded by the Islamic institutions. Competition has increased between the Islamic houses who must strive to develop and offer a full product range to an increasingly discerning customer base.

Additionally, the technical ability of the Islamic institutions has progressed immeasurably during the past ten years and we have also witnessed the emergence of aggressively positioning Islamic investment banks and institutions.

These include The Islamic Investment Company of the Gulf, TII, the International Investment Group and First Islamic Investment Bank (formerly Majestic Global Investments) which have concentrated on the origination of performance investments for their shareholders and HNW clients.

Similarly, there is impressive strength in the capability and experience of Islamic banking professionals. A number of individuals have lengthy previous career positions in the international equity markets and are able to provide solid technical support in developing, monitoring and even managing their organisation’s products.

Although there is still no uniform Sharia approval of international equity investment, many esteemed Sharia scholars are adopting a more pragmatic approach to the stock selection process that can be directly attributed to enhanced communication and information flow from the executives of the Islamic institutions that they represent.

Obviously, the full endorsement of a panel of widely respected Sharia scholars is the only way to achieve wide acceptance of a product. Thus, informed involvement of the scholars results in development of the approved universe of stocks, enabling the creation of a diversified portfolio that is well placed to achieve targeted returns.

As for organisations (not mentioned) seeking to enhance their revenue through inappropriately high management fees, supposedly justified by the added cost of structuring and obtaining Sharia endorsement of Islamic products, it has to be said that that argument is not particularly convincing.

Stock Selection Procedures

There is now greater consistency in the guidelines that have emerged on the structure and criteria for selecting stocks for an Islamic portfolio. Yet there is no definitive answer to stock-picking, which will depend upon individual fund sponsors and the opinion of the individual Sharia advisors.

What is universally accepted is that some stocks are always prohibited, or Haram, and these include:

i). companies involved in the production or distribution of liquor (such as breweries);

ii). companies involved in gambling (such as book-making activities);

iii). companies involved in the conventional financial services industry, including banks, securities houses and insurance groups;

iv). those involved in the production and sale of armaments;

v). those active in the production of pork products and non-halal meat; and, at the specific request of our advisors.

vi). manufacturers of tobacco products.

Additionally, Sharia advisors are reluctant to approve investment in hotel and leisure groups that derive substantial profits from bar sales, night-clubs and casinos. Investments in airlines can pose similar problems if it is determined that a high percentage of their revenue is attributable to on-board liquor sales.

After considering the primary activity of the stock in question, a closer look must be taken at the activities of subsidiaries and other group companies. For example, a major conglomerate that derives significant income from a subsidiary involved in conventional banking or financial services may not be included.

After considering the primary activity of the stock in question, a closer look must be taken at the activities of subsidiaries and other group companies. For example, a major conglomerate that derives significant income from a subsidiary involved in conventional banking or financial services may not be included.

There has been considerable ongoing debate about the impact of Riba in the performance of Western equities. This has been a major factor in limiting the wider acceptability of international equity investment by the Islamic sector. Most international companies borrow at interest from conventional banks and, if they have no need of leverage, they will almost certainly be depositing funds at interest in the conventional markets.

An approach to this has been to consider the debt/equity ratio of the company. Individual Islamic institutions apply their own leverage restriction and the level of acceptability varies, depending upon Sharia opinion. Generally, the acceptable level falls between 20% to 40%, and it is true to say that most scholars will reject a stock that is deemed to have too high a gearing.

If a leverage limitation is imposed, there will still be a percentage of corporate profitability derived from prohibited financial activity. Similarly, a portion of the stock dividend will be tainted by Riba and is therefore unacceptable income for investors. The current solution to this is to apply a formula to calculate the impact of Riba in the dividend.

Dividend-stripping policy also varies. Dresdner Kleinwort Benson’s policy has always been to identify an upper approximation of the tainted income portion, which can then be remitted to approved charities by the custodian or portfolio manager before distribution to the client, or paid in whole to the investor, who then makes the charitable donation at his own discretion.

Having created an acceptable stock universe, it must be maintained through regular and diligent monitoring. In addition to annual, audited financial statements, as much inflow of information as possible should be gathered on individual stocks to ensure continuing acceptability.

Managers endeavour to undertake frequent interim reviews as, clearly, company activity is ongoing and from time to time previously acceptable shares will need to be divested or removed from the approved register and rendered ineligible for future acquisition.

Monitoring Performance of New Funds

Islamic investment funds remain high on the agenda. This year Flemings is to add an emerging markets product to complement the Oasis Global Equity Fund. Further prominent Islamic institutions, including AI Rajhi Banking and Investment Corporation, Faysal Islamic Bank and First Islamic Investment Bank have recently announced, or intend to launch, new equity funds.

For investors this must be good news. A range of competing products launched by very reputable institutions affords choice and, once essential Sharia stipulations are incorporated in the management of the fund, it will be up to the manage r to achieve the targeted performance.

The nature and volatility of the equity markets means that investors seeking enhanced profitability will be accepting a greater underlying investment risk. Fund managers will endeavour to address this with an investment portfolio that encompasses a range of developed, international markets and industry sectors and perhaps a spread of emerging market investment, too.

Initially, there was considerable concern that there would be little to choose from in the performance of comparable Islamic equity funds after rigorous screening. This has not, in fact, been the case, as different Fatwas allow different investment focus and trading methodology and this, coupled with the varying approaches of individual fund managers, has resulted in fairly wide-ranging performance.

Selecting the right fund manager is clearly critical to the success of a fund. A number of top houses are already active in Islamic fund management, having been drawn towards the Islamic financial system’s developing profile and the opportunity, in some instances, of combining their traditional capabilities with those of the sponsoring Islamic institution.

Nowadays, investment security and the perception of liquidity are especially important to investors. The added involvement of a custodian and administrator (with appropriate credit ratings and low-risk domiciles) to segregate client funds, make settlements and monitor net asset value, assures the assets of the fund.

Many recent funds have been registered in Dublin under Central Bank of Ireland regulation. Other registration centres include Luxembourg, the Channel Islands and Grand Cayman. Listing can be arranged for the local market.

Numerous recent and regrettable events have led to derivatives being perceived as high-risk instruments of speculation and, consequently, the acceptance by Sharia scholars of recognised hedging techniques is very limited.

One might argue that they can be created with-low-risk perspective to protect investors from unnecessary market volatility, and a number of prominent practitioners in our market now propose that derivatives will be essential to the complete Islamic financial system.

Some progress is being made in the application of derivatives to mitigate risk in commodity and trade transactions but, for the present, the topic is controversial and the use of stock options and short positions are still widely rejected.

Presently, most Islamic equity funds measure performance against a conventional industry benchmark such as the MSCI Index for global equity. The relevant indices may be subjected to Islamic screening for the sake of fair comparison and, in Malaysia, Islamic indices for regional markets are already published by some organisations.

It is essential that investors have access to indicators that measure the performance of their investment, although until the Islamic funds have been given the opportunity to develop a sufficient track record, it will not be possible to make even comparison.

Long-Term Equity Investment

Whilst considering the growing range of equity investment vehicles, we should also touch upon the increasing requirement for global infrastructure financing, which is particularly apparent through new projects being developed now in many Muslim countries.

There has certainly been institutional and private sector involvement in project financing, but much has related to the financing of individual, asset-backed tranches through Murabaha, Istisna and Ijara contracts. There is clearly scope for further commitment through equity participation.

The Musharaka contract, is central to the concept of Islamic financing. It has not, however, been as widely utilised as may have been possible (with the exceptions of Sudan and Iran) because of the inherent risks and often long-term nature of the investments.

We noted previously that recourse to liquidity is a priority for Islamic financial institutions that have ongoing obligations to short-term depositors and are unable to commit to substantial term investment without regular income streams.

Therefore, much of the locally raised equity for projects in the Middle East and surrounding regions has been privately placed with corporate entities and HNW families that may have a greater tolerance of the risk profile of the investment and less concern about locking away liquidity.

For those willing to invest, opportunity abounds and the desire amongst several Gulf governments to raise finance for build-ownoperate infrastructure projects is prompting a review of existing investment laws. New projects of this type are now regularly being developed in partnerships between, typically, a local organisation, a government entity and a foreign technician.

One might argue that the principles of Islamic finance should result in the formation of Musharaka partnerships for mutual fund management. In the Western scenario the portfolio manager is given funds to manage by an investor and does so, taking a cut of the investor’s return as his fee. In the event that losses are incurred, these are usually borne by the investor.

By example, when Dresdner Kleinwort Benson launched the AI Meezan Commodity Fund in co-sponsorship with the Islamic Investment Company of the Gulf, in addition to incorporating our management skills with the Sharia directives of IICG, both institutions felt that it was important to become shareholders. Accordingly, although there are no guarantees for investors, the performance is shared by the sponsors of the Fund, and we feel that we have a genuine risk- bearing and, hopefully profitable, partnership.

Malaysia

In Malaysia, the development of the Islamic capital market is a primary focus and, in 1994, Bank Islam Malaysia Berhad (BIMB) launched BIMB Securities Sdn Bhd. BIMB Securities is a stockbroking company operating within the same institutional and regulatory framework as other member companies of the Kuala Lumpur Stock Exchange (KLSE). As it is 70% owned by BIMB, parts of its operations have been modified so that all activities conform to the Sharia.

Subject to compliance with Sharia principles, the services provided by the Company correspond to those offered by other securities companies and include:

i) dealing in securities listed on KLSE and other recognised exchanges;

ii) asset management;

iii) nominee/custodian and registration services;

iv) investment research and advisory services; and

v) corporate advisory services, underwriting and placement.

BIMB Securities has an approved list of stocks that are screened to ensure compliance with Islamic principles. Following the establishment of the company, other existing organisations have designated a specialised section of their operation to offer similar Islamic stock-broking services.

In 1995, BIMB itself launched an Islamic Unit Trust investing in the stocks of the Approved List and in 1996 Malaysia’s Abrar Group International launched the Abrar Investment Fund, an open-ended equity unit trust invested through the KLSE (60%) and internationally (10%) with a further 20% placed in the Islamic money market.

Interestingly and perhaps controversially, Abrar Group is developing Islamic futures trading with a committee established by the Kuala Lumpur Options and Financial Futures Exchange, which has stated its commitment to list derivatives on an index of Halal shares to attract Muslim investors.

Although reference is made to the prevailing lack of uniform opinion between Sharia scholars in the Arab countries and those in Malaysia, Rashid Hussein Berhad, which itself launched an Islamic Index of Sharia-endorsed stocks, is the manager and joint sponsor appointed by AI Tawfeek Company for its closed-ended Malaysian Equity Venture Capital Fund.

Conclusion

Observers have criticised the lack of appropriate investment product for retail investors. Whilst all will acknowledge the importance of bringing diversified Islamic financial products to the man in the street, due regard must also be paid to the anticipated performance and risk profile of investment opportunities being delivered.

It is essential that clients are properly advised and have a thorough appreciation of those risks, including potential market volatility, absence of capital protection or any restrictions impacting the trading methodology of the fund managers.

Many of the Islamic equity funds are open-ended and structured to deliver much-needed asset diversification with in-built liquidity with the institutional client in mind. Even then, when seeking enhanced performance, it is easy to overlook the fact that although speculative positioning in the equity markets can yield spectacular, one-off profits, stocks acquired for investment purposes generally need to be held for several years.

We should be very encouraged by the relatively recent and rapid development of Islamic equity products. Investors are already able to choose from a broad array of funds, investing in both listed and venture equity with global, regional and specialised focuses. Not only does it assist in further expanding the Islamic financial products range, it also demonstrates that concerted effort results in solutions being found to seemingly insurmountable problems such as those that have previously hindered the innovation of equity investment opportunities.

Furthermore, some important, cross-market relationships are being formed that can only enhance the quality of product offerings and indeed the level of manpower and capital resources made available to research, develop and implement innovations for the Islamic market.

Edited By Asma Siddiqi

Institute Of Islamic Banking And Insurance London

Comments

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.