ISLAMIC INTEREST-FREE BANKING A THEORETICAL ANALYSIS

MOHSIN S KHAN

The general resurgence of fundamental Islamic values in many parts of the world has manifested itself on the economic front as well, with a number of countries having moved toward the transformation of their economic systems to accord more closely with the precepts and conditions of Islam. The most far-reaching attempts in that direction have taken place in the Islamic Republic of Iran and in Pakistan, although this phenomenon can be observed to varying degrees in most Islamic countries. More significant, the process of Islamisation of these economic systems appears to be gaining momentum over time.

This shift toward the institution of an Islamic economic system has generated widespread interest not only on the part of economists in the countries directly involved, but also in the economic profession at large. The recent outpouring of papers dealing with a variety of aspects of the structure and operation of the Islamic economy attests to the importance being attached to the subject. Whereas until the mid- to late 1970s writings on the Islamic economic system were relatively scarce, the picture has changed quite dramatically in the 1980s. In the past four or Five years there has been a remarkable increase in the number of papers and books, conferences and seminars devoted solely to Islamic economics and even the production of a journal, the Journal of Research in Islamic Economics (Jeddah, Saudi Arabia).

Because this material is still relatively new, considerable misunderstandings still exist about what Islamic economics is and how an economic system based on Islamic criteria differs from other economic systems. The popular perception is that it is the concept of an interest free financial structure that in essence characterises the Islamic economic system, and discussions of the subject often tend to treat Islamic economics and interest-free banking as one and the same thing. Because the explanation of interest is perhaps the most controversial of the policy proposals contained in Islamic economics and has typically been the first step in the Islamisation of the economy, it is perhaps only natural that the issue of an interest-free economy has received the most attention. Although the elimination of interest is certainly a central tenet of the Islamic economic system, it should be stressed that it is by no means an adequate description of the system as a whole or, for that matter, even of Islamic banking.

Broadly speaking, the term “Islamic economics” defines a complete system that prescribes specific patterns of social and economic behaviour for all individuals. It deals with a wide-ranging set of issues, such as, property rights, the incentive system, allocation of resources, types of economic freedom, the system of economic decision making and the proper role of the government. The overriding objective of the system is social justice and specific patterns of income and wealth distribution, and consequently economic policies are to be designed to achieve these ends. Aside from the issue of a zero-interest rate, Islamic economics also offers fairly precise guidelines on, for example, tax policy and the orientation of government expenditures. Islamic banking is expected to participate actively in achieving the goals and objectives of an Islamic economy; consequently. Islamic banking is to be conducted “in consonance with the ethos of the value system of Islam” (Ahmad 1984). Even though the terms “Islamic banking” and “interest-free banking” have been used interchangeably, it has been stressed by several writers that the former is a more normative concept whereas the latter is the actual practice or mode of banking.

Despite the increased study and discussion of the theory and practice of Islamic banking, the subject still presents several puzzles for academics and policymakers alike. Whether a system that forbids the payment or receipt of interest can be viable in a modern economy is a question often raised by economists, especially those trained in the Western economic tradition. The writings of Muslim scholars have helped to broaden understanding somewhat, but there still exists substantial confusion on the main issues. In this paper, an attempt is made to answer some of the basic questions that arise by providing, with the tools and concepts of modern Western economics, a formal analysis of the main features of Islamic banking. By doing so, it is hoped that the gap between Muslim scholars and the profession at large will be narrowed.

In more specific terms, the paper presents a theoretical model of an interest-free banking system that is considered to be broadly consistent with the principles of Islam. The purpose of the exercise is fourfold: first, to show that the Islamic banking system can be rationalised in a neoclassical framework; second, to demonstrate that, when cast in this formal way, the model underlying Islamic banking is not totally alien to Western economic thinking (indeed, it is pointed out that variants of such a system have appeared in the writings of a number of eminent economists, such as Fisher (1945), Simons (1948), and Friedman (1969)); third, to argue that there may be circumstances in which an Islamic banking system would be relatively more stable than the traditional, or interest-based, banking system in the face of certain types of shocks; and finally, to propose how the Islamic banking system should be implemented so as to maximise its inherent benefits.

To define the scope of the study, it is necessary to point out the limitations that have been placed on the analysis. First, a complete and detailed description of Islamic banking, or of how it is expected to work in the countries that have adopted such a system, is not attempted. Rather, this paper focuses exclusively on the analytical features of Islamic banking. Second, and following from this limitation, the model developed here is a simple one that incorporates only those elements of Islamic-type banking that are considered essential to the argument. Although it is not intended to be a fully realistic representation of the complete Islamic banking system, the model nevertheless is able to highlight the principal issues of concern. Last, the paper does not try to imply that the Islamic system is always more stable, or that traditional banking systems are necessarily unstable; all it suggests is that there may be situations in which an Islamic financial system can adjust relatively faster to shocks than would the traditional system.

The remainder of the paper proceeds as follows. In Section I, the background for the policy of elimination of interest in an Islamic economy is described, as well as the expected mode of operation of such an economy. This discussion sets the stage for the formulation of the model in Section II. In this section, the dynamic properties of the model are examined under the assumptions of both fixed and flexible prices. It is shown here that the results do not depend on what is assumed about prices; more generally, the results turn out to be equally applicable whether one has a Keynesian or a classical view of how the economy works. The concluding section brings together the main findings of the exercise and attempts to draw some policy implications.

GENERAL ASPECTS OF AN ISLAMIC INTEREST-FREE FINANCIAL SYSTEM

It is useful to begin examining the Islamic banking system by first defining some basic terminology. Riba is the Arabic word for the predetermined return on the use of money. In the past there has been dispute about whether riba refers to interest or usury, but there is now consensus among Muslim scholars that the term covers all forms of interest and not only “excessive” interest. Thus, in the ensuing discussion, the terms riba and “interest” will be used interchangeably and an Islamic banking system will be one in which the payment or receipt of interest is forbidden. An interest-based, or traditional, banking system is defined as asymmetrical, with interest being paid and charged for the use of funds.

The Qur’anic restriction against interest is quite explicit and has to be taken as axiomatic. Transactions based on riba are strictly prohibited in the Qur’an, as the following verse forcefully states:

“Those who devour riba will not stand except as stands one whom the devil hath driven to madness by (his) touch.” (II: 275)

To see that there can be no doubt of the condemnation of the system of interest, and the penalties that would be imposed if the rule were not observed, consider the following verse:

“0 ye who believe! Observe your duty to Allah and give up what remains (due to you) from riba, if ye are (in truth) believers. And if ye do not, then he warned of war (against you) from Allah and His Messenger. And if ye repent then ye have your principal (without riba). Wrong not, and ye shall not be wronged.” (11:278-79)

Although there have been discussions among Muslim scholars on the reasons for this prohibition against interest, it is obvious from the above quotations that there is no real room for differences in interpretation about whether interest can or cannot be paid in an Islamic economy. It is the general view that it is considerations of equity and protection of the poor that lie behind the strong condemnation of interest-based transactions. In any case, the Islamic economic system, and of course the corresponding banking system, has to operate within the prescribed framework, which does not permit interest.

The concept of an economy in which interest is not allowed appears quite counterintuitive to many observers. Arguments that such a system is unlikely to work efficiently in the short run, and in the long run will result in an eventual drying up of savings and investment, have frequently been made in this connection. This view, however, tends to reflect a basic confusion between the terms “rate of interest” and “rate of return.” Whereas Islam clearly forbids the former, it not only permits, but rather encourages, trade and therefore profits. For example, consider this verse from the Qur’an:

“That is, because they say: Trade is just like riba-, whereas Allah permitteth trading and forbiddeth riba “(11:275)

Intangible rewards are also permitted; using the Arabic term Sadaqat, for charity or alms, the next verse from the Qur’an says that:

“Allah has blighted riba and made Sadaqat fruitful.” (11:276).

In essence, what is forbidden in Islam is the fixed or predetermined return on financial transactions and not an uncertain rate of return, such as that represented by profits. From this distinction, it follows that, if a banking structure could evolve in which the return for the use of money would fluctuate according to actual profits made from such use, the resultant system would be consistent with the guidelines of Islam.

The view that profits are perfectly legitimate has provided the foundation for the development and implementation of Islamic banking. In this system, profits and losses are to be shared between banks and economic agents according to certain predefined rules. Specifically, the depositor would not be guaranteed a predetermined return on the nominal value of his deposit by the bank, but would be treated as if he were a shareholder of the bank and would thus be entitled to a share of the profits made by the bank. The system is symmetrical, so that if the bank incurs losses the depositor would share in these as well, and the nominal value of his deposit would be reduced. On the other side of the balance sheet the bank could also not charge a fixed rate of interest on its loans but instead would have to engage in some type of a profit-and-loss-sharing agreement. At the simplest level the Islamic system can be considered as an equity-based, rather than an interest-based, system. The depositor in essence purchases equity in the bank, and the bank in turn has an equity position in whatever activity the borrower uses the funds for. (This does raise some interesting issues, yet to be resolved, regarding consumption loans.) The distinction between equity-based and interest-based systems is crucial and will be used in the remainder of the analysis.

The earliest modern example of a bank established along the principles of profit-and -loss-sharing was the Myt Gamt Savings Bank in Egypt in the early 1960s. The 1970s saw the emergence of similar banks in Kuwait, the United Arab Emirates, Jordan, Sudan and Pakistan. Two such banks were also established in Luxembourg and Switzerland, and, with the active encouragement of the Kingdom of Saudi Arabia, an international development bank – the Islamic Development Bank – was set up in Jeddah in 1975. In most Muslim countries Islamic banks, operate side-by-side with traditional banks but certain governments have taken steps to eliminate the latter over time. For example, the Government of Pakistan in 1978 started a gradual process of eliminating interest-based transactions entirely from its banking system; as of July 1, 1985, all transactions by banks were required by law to be conducted solely on an equity-participation basis. Similar steps have been announced by the government authorities of the Islamic Republic of Iran.

That the process of establishing Islamic banking appears to be well entrenched, at least in Pakistan and the Islamic Republic of Iran, raises two related questions. Does such a system make theoretical sense, and can it work in a modern setting? The first of these questions has been examined in a number of papers that show that it is indeed possible to rationalize the profit-and-loss-sharing system through the use of risk and uncertainty analysis (for example, Naqvi (1982) and Khan (1984)). Basically, these papers replace a certain, or predetermined, rate of interest with an expected rate of return and go through the usual procedures to show that this change does not affect the conclusions about standard banking and macroeconomic behaviour in any fundamental sense. With respect to the second question, however, because the experience with an economy-wide profit-and-loss system is relatively recent, it is not possible to state with confidence that such a system will function as well, or better, than the traditional banking system. There are, of course, those who argue on mostly a priori grounds that it will, but clearly, in the absence of empirical analysis, the issue is far from settled.

Once one gets past the terminology and the interest-free and interest-based distinction and recognises that Islamic banking is really a particular variant of equity-participation systems, it can be seen that proposals for reform of the traditional banking system along similar lines have been made at various times in the United States. These times have in general corresponded with episodes of banking crises, and the most ardent proponent of an equity-based financial system was Henry Simons (1948). Arguing in the context of bank collapses in the 1930s that the fractional-reserve banking system was “inherently unstable,” Simons proposed that traditional banks should be replaced by two separate financial institutions:

“First, there would be deposit banks, which, maintaining 100 percent reserves, simply could not fail, so far as depositors were concerned, and could not create or destroy effective money. These institutions would accept deposits just as a warehouse accepts goods…. A second type of institution, substantially in the form of an investment trust, would perform the lending function of existing banks. Such companies would obtain funds for lending by sale of their own stock, and their ability to make loans would be limited by the amount of funds obtained.”

Although Simons’ calls for a sharp distinction between the payments and portfolio functions of banks – and for a 100 percent reserve requirement on the former – were rejected in favour of official deposit insurance at that time, interest in Simon’s ideas has remained. Friedman (1969) agreed with Simons on the idea of a 100 percent reserve requirement, but more on the grounds that such a system would reduce government interference with the lending and borrowing operations of banks and thus would increase economic freedom. In connection with bank failures in the United States during the 1980s, there has been a revival of proposals for the equity-based system that Simons advocated. Papers by Kindleberger (1985), Kareken (1985), and Golembe and Mingo (1985), presented at a conference organised by the Federal Reserve Bank of San Francisco, again raise the issue of the potential financial instability of a fractional-reserve banking system combined with official deposit insurance. Kareken and Golembe and Mingo argue that bank failures are special because, unlike bankruptcies of firms in general, they affect the payments mechanism of the economy. Consequently, what must be protected is the efficient functioning of the payments mechanism and not necessarily the overall lending and borrowing operations of banks. These authors would, therefore, have the government separate the provision of payments services from lending sei-vices and in effect create the two types of banks that Simons had in mind. The payments side of banking (that is, transaction balances) would be backed 100 per cent by some safe security (say, U.S. Treasury bills), whereas the portfolio activities would be effectively unregulated. Neither of these schemes, nor the one proposed by Simons, are significantly different from the Islamic banking systems being implemented in several countries, at least on the deposit side. At the same time, however, it should be stressed that the Islamic banking system goes further and requires that loans and advances made by banks also be based on equity participation.

There are many reasons advanced in the literature for the possible instability of the traditional banking system. In Simon’s view, the basic flaw in the traditional system is that, as a crisis developed and earnings fell, banks would seek to contract loans to increase reserves. Each bank could do so, however, only at the expense of other banks, and in the process some banks would become insolvent and be forced to close. Alternatively, Mayer (1974) contends that banks tend to switch from techniques of asset management to those of liability management in the face of a crisis, and that this practice has increased in the U.S. banking system. In other words, if banks raise interest rates to attract or retain deposits in problem situations, and if the total stock of deposits is fixed in the short run, the process would clearly be unstable and would eventually lead to bankruptcies. In such circumstances, any system that guaranteed the transaction-balances component of deposits and eliminated the need or incentives for liability management would likely stabilise the process.

In the following section, it is shown formally how an equity-based banking system of the Islamic type would operate and how it would be stable in the context of real shocks.

A FORMAL MODEL OF ISLAMIC BANKING

The framework used here to represent the Islamic banking system is based on an aggregate macroeconomic model developed by Metzler (1951) and extended by Fernandez (1984). The model is quite simple, and, although it incorporates some fairly restrictive assumptions, it turns out to be a very useful device for the purpose at hand. In this section, two versions of the basic model are considered. The first takes prices as fixed, or predetermined, and real output as endogenous; in the second version the price level is assumed to be flexible, and output in turn is assumed to be exogenous. These two versions can also be respectively interpreted as the Keynesian or classical representations of the basic model.

The Basic Model with Fixed Prices

The macroeconomic model contains a capital market, a money market, and a market for goods. For simplicity it is assumed that all real income goes to capital rather than being divided between capital and labour, as is more customary. Metzler (1951), for example, assumes that capital receives a constant proportion of national income, and his approach could easily be followed without affecting the analysis. The three markets in the model are described in turn below.

Capital Market

Consider an economy in which banks are the only intermediaries that connect saving and investment. These banks are treated as if they were simply firms that issue shares (deposits) and derive their earnings from investments.

Economic agents hold their savings in the form of deposits whose nominal value is not guaranteed, and the rate of return they receive from these deposits (that is the yield on shares) is also not predetermined and can vary. Indeed, there is no restriction preventing the rate of return from becoming negative, since this would only imply that the value of shares falls. All investments in the economy are also assumed to be undertaken by borrowing from banks.

Because the price level is given, one can use the simple discounting formula suggested by Metzler (1951) to relate the real value of the banks’ shares to the capitalised value of the future real earnings of the banks.

S/p = s = y/r (1)

where

S = nominal value of shares

P = price level

a = real value of shares

y = real income

r = real yield or real rate of return on shares.

If banks are assumed not to hold any reserves and to have zero net worth, then equation (1) defines the balance sheet of the banking system. The assumption that banks cannot absorb losses through reserves or net capital is also not crucial, since the concern here is with the issue of bankruptcies. Basically, ignoring the reserves or the net capital of banks is tantamount to assuming that the potential losses that would occur in the event of a failure exceed the provisions that a bank can reasonably be expected to make against them.

The balance sheet of the simplified aggregate banking system in real terms would therefore be,

Banking System

Assets / y/r

Liabilities / S/p

Money Market

Money is the asset in the model and is considered to consist solely of currency, assumed to be exogenously supplied by the government. In other words, all money in the model is “outside” money. Total real wealth w is defined as w = m + s, where m is the stock of real money balances (m = M/P) and M is the exogenously given nominal stock of money. Equilibrium in the money market is determined by the following:

m/s = g (r), g, (2)

where the proportion of wealth held in the form of money depends negatively on the real rate of return on shares. From equation (1), s = y/r; therefore, the equilibrium condition in the money market can be rewritten as

m = g (r). y/r. (3)

Goods Market

The goods market is assumed to be characterised by slow adjustment, and output is assumed to respond to variations in excess aggregate demand. This formulation is not difficult to justify for the case in which prices are fixed. (The alternative case of flexible prices is taken up later.) Specifically, the relationship between real income, or output, and excess aggregate demand can be derived using a standard Keynesian-type framework, with the assumption that the economy is closed and there is no explicit government sector Real aggregate demand (yd) is defined as

yd = C (r, w) + I (r)

C, <O,.Cw>O, I,<O, (4)

where C(r,w) is a standard consumption function, with wealth as the relevant scale variable, and I(r) is the investment function. Note that from equation (1), total wealth can be written as

w = m + y/r.

The assumption of slow adjustment in the goods markets can be represented by the following differential equation for output:

dy/dt = y = B[C (r,m + y/r) + I(r)-yl., B>0 , (6)

where the expression inside the brackets is excess aggregate demand. This can be written as a reduced-form equation:

y = f(r, y;m)

fr < 0, fy > 0, Fm > 0, (7)

Equation (7) can be viewed as a dynamic form of the IS curve in which real income responds positively to excess aggregate demand, which in turn is a negative function of the real rate of return and (with marginal propensity to consume, aC/ay, assumed to be less than unity) of real income. The change in real income is a positive function of (exogenous) real money balances.

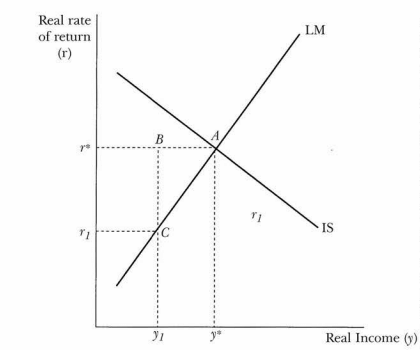

He noted that the model here is a dynamic variant of the standard IS-LM model, and no special factors have had to be introduced up to now. In analysing the Islamic banking system, the crucial point to remember is that the nominal value of shares (S) is not guaranteed to a depositor and thus can be treated as perfectly flexible. In the model, equation (3) ensures that the capital and money markets are continuously in equilibrium, whereas, from equation (7), real income adjusts slowly to any shocks to excess aggregate demand. From equation (3) for the money market and equation (7) for output, one can derive a standard IS-LM paradigm to determine the equilibrium values of the real rate of return r* and of real income y*. Given r* and y*, it is a straightforward matter to obtain the equilibrium real value of shares, s* = y* /r*. The basic system used to describe the Islamic banking system is depicted in Figure 1. (Note: Although Figure I is drawn for positive values of r, the real yield on shares could be negative without affecting the argument.

To examine the dynamics of the system, consider the case of an exogenous fall in real income (real earnings) of banks from y* to yl,

Figure 1. Islamic Banking System with Fixed Prices

in Figure I. At point B there is an excess supply of money that causes an instantaneous decline in the real rate of return on shares from r* to rl (0 point C). At C, with real income at yl and the real rate of return at rl, however, there is excess aggregate demand. This excess demand will move real income slowly back toward y* to eliminate the disequilibrium in the global market and as real income grows, the real rate of return will also rise toward r*. Equilibrium will once again be reached at the original steady rate – that is, at A with r = r* and y = y*.

From equation (1), one can trace what happens to the real value of shares during the process of adjustment. As the real rate of return declines, the real value of shares falls immediately from s* = y*/r* to SI = yl /rl to maintain continuous equilibrium in the capital market. This result follows because the nominal value of shares is flexible and can thus adjust immediately to clear any disequilibrium in the capital market. This feature ensures that the system is dynamically stable.

By contrast, in the traditional banking system, the nominal value of shares (deposits) is guaranteed to the depositor by the bank (if the price level is given, then the real value obviously is also guaranteed), and it is this guarantee that distinguishes the two systems. In standard banking systems the individual is assured of the nominal value of his deposit, and if the bank pays interest on these deposits, the rate of return that he will receive is also predetermined. In most countries there exists some form of official insurance scheme that backs the guarantee provided by banks; even if there is not, it is normally assumed that the government would step in should the need arise.

In the analysis developed here, the introduction of a guarantee for the nominal value of the shares simply means that the balance sheet of the banking system is now written as

S/P = y/r. (la)

where S is the predetermined, or guaranteed, value of shares. Although it is possible to show that the introduction of a deposit guarantee – in other words, using equation (la) in place of equation (1) in the model – does not change anything insofar as equilibrium behaviour is concerned, important differences can emerge in the transition process. As discussed above, in the Islamic banking model any divergence between the real values of assets and liabilities would be immediately reflected in a corresponding adjustment in the nominal value of shares. In the traditional banking system, however, because the nominal value of shares is guaranteed and the interest rate is predetermined, changes in y will not necessarily cause immediate variations in the real value of shares. In the short run, therefore, one could have y/r not equal to S/P, and the fundamental question becomes how the system can be expected to adjust to this disequilibrium.

One way, of course, would be for banks to cover the discrepancy between assets and liabilities through a drawdown of reserves or a reduction in net capital. But if losses exceed available reserves, as has been assumed here, banks would presumably face the possibility of runs on deposits and of bankruptcy as net worth became negative (recall that the net worth of banks is assumed to be zero to start with). In general, in such circumstances, the government would enter into the picture and would assume the liabilities of the banks, either in its capacity as the ultimate guarantor of deposits or, more important, to protect the payments mechanism. In any case, the depositors would be repaid by the government from resources obtained through taxes or borrowing. If one ignores distributional complications, what the government has done is to reduce wealth by a capital levy on shareholders, either imposed now or in the future, that would be equal to the loss of assets of the banks. The end result of such an operation would be equivalent to that observed in the case of the Islamic banking model: the fall in real earnings of banks would be matched by a decline in real wealth, with the government intervening to ensure such an outcome.

Short-run differences between the two systems can, however, arise for a variety of reasons. For example, the public may not see through the “veil,” may not believe that despite the government’s actions real wealth has been reduced, and may thus not alter its behaviour. The behaviour of banks may also create short-run problems. Even though the liabilities of the banks may be insured directly or indirectly by the government, it has been assumed by Mayer (1974) and Femandez (1984), among others, that banks may try to postpone bankruptcy by resorting to liability-management techniques and raising interest rates to bid for deposits. Such actions, which reflect myopic behaviour on the part of bankers, can easily lead to instability because attempts to increase interest rates would reduce y/r even further. In the Islamic banking model, the market immediately writes down the real value of shares, and these types of short-run phenomena cannot arise.

The Basic Model with Flexible Prices

The analysis can be extended to consider the alternative case in which output is exogenously given and prices adjust to excess aggregate demand. This model, in contrast to the Keynesian-type model of the previous subsection, therefore corresponds more to the classical system. In terms of real money balances, the adjustment function can he specified as

M = -f (r, m; y*)

fr<0, fm>0, fy<0, (8)

where m is the change in real money balances and f (r, m; y*) is the excess demand function for an exogenously given level of (long-run) real income, y* Equation (8) is now used in place of the output adjustment equation (7) that was specified in the case of rigid prices. Slow adjustment in the goods market has been maintained to highlight the dynamic properties of the system, although one could easily assume that prices adjusted instantaneously to clear the market. This would simply amount to specifying f (r, m; y *) = 0 in equation (8).

In this system, equations (1), (3), and (8) can be combined to determine the endogenous variables r, m, and s. The model is described by Figure 2, where my = O represents the locus of points that clear the goods market and where ry. = 0 is the corresponding locus of points that clear the money market, m = g (r). y*/r. As before, once m* and r* are determined, one can derive the value of the real value of shares s , which equals m*/g (r *).

The real value of shares does not behave exactly the same way as it did in the case of fixed prices. Initially the real value of shares declines sharply, since at B

M*/g (rl) < m/ g (r*),

and then continues to fall as the system approaches the steady state at C. The path followed by the real value of shares is a consequence of the assumption of slow adjustment of prices; if instantaneous adjustment of the goods market were allowed, one would, observe the economy moving directly from A to C, and the real value of shares would as in the fixed-price case, move immediately from.s* = y*/r* to sI = yl/r2.

Again, the process can be replicated by the traditional banking model if both the public and bankers behave rationally in the short-run, and if the government moves rapidly to correct the disequilibrium between assets and liabilities that results from the fall in real income from y* to Yl. If not, the traditional banking system would adjust slowly to the real income shock and could quite easily become unstable.

CONCLUSIONS

Although the number of studies on Islamic economics and Islamic banking has grown enormously in recent years, there is still a dearth of analytical work on the subject. In many ways, the lack of understanding and confusion that exists about Islamic economics can be attributed to the virtual absence of formal descriptions of the theory underlying the proposed system. In this paper, an attempt has been made to provide a theoretical depiction of the Islamic banking system by formulating a relatively simple model that explicitly incorporates the constraints imposed by religion on the conduct of financial transactions. As was shown in the paper, this model does provide a reasonable portrayal of the types of Islamic banking systems that have been put into practice in certain countries. The exercise further demonstrated that standard economic concepts and methods can be fruitfully employed to analyse issues in Islamic economics.

The model that has been developed in this paper also turns out to have many similarities with standard models used to analyse the behaviour of banks at an aggregate level. Indeed, it is readily apparent that the Islamic model of banking, being based on principles of equity participation, bears a striking resemblance to proposals made in the literature on the reform of the banking systems in many countries, particularly in the United States. The paper demonstrates that the Islamic system may well prove to be better suited to adjust to shocks that result in banking crises and disruption of the payments mechanism of the country. In an equity-based system that excludes predetermined interest rates and does not guarantee the nominal value of deposits, shocks to asset positions are immediately absorbed by changes in the values of shares (deposits) held by the public in the bank. Therefore, the real values of assets and liabilities of banks in such a system would be equal at all points in time. In the more traditional banking system, since the nominal value of deposits is fixed, such shocks can cause a divergence between real assets and real liabilities, and it is not clear a priori how this disequilibrium would be corrected and how long the process would take. In other words, there is a rigidity in the traditional banking system that prevents instantaneous adjustment, and this rigidity can lead to possible instability.

Thus, as argued in this paper, the principal difference between Islamic and traditional banking systems is not that one allows interest payments and the other does not. The difference stems from the fact that an Islamic system treats deposits as shares and accordingly does not guarantee their nominal value. In the traditional banking system, such deposits are guaranteed either by the banks or by the government. This distinction has apparently not been generally appreciated in the literature. In essence, the interest rate issue is shown not to be central from an economic or analytical point of view, and one can argue that the debate in many ways has been misdirected.

It should be acknowledged, of course, that the scope of this paper has been fairly limited, and several interesting questions associated with Islamic banking remain as yet unanswered. The model specified was a somewhat stylised one, and certain restrictive assumptions were imposed to highlight the essential features of the Islamic financial system. Obvious generalisations of the approach here would have to examine in greater detail how both deposit and loan behaviour can be theoretically modelled within an equity-based system. Moreover, the analysis here was restricted to the operation and practice of banking under the Islamic system. The effects that the adoption of this system would have on saving, investment, the level of financial development, and so forth and, furthermore, the question of how monetary, fiscal, and exchange rate policies can be expected to operate in such an environment were beyond the scope of the analysis presented here. In addition, at this stage, it is not possible to say very much about the effects that the introduction of uncertainty created by the elimination of a predetermined rate of interest on financial transactions would have on basic economic behaviour and on the efficiency of the financial system.

Perhaps even more important is the question of whether the profit-and-loss sharing practice meets the fundamental objectives of Islamic economics relating to income and wealth distribution. Addressing these various issues will clearly require concerted efforts at both the theoretical and empirical levels.

Despite these caveats, it is still possible to draw certain policy implications from this study that relate to the practice of Islamic banking. The equity-based system being implemented in Muslim countries appears to have considerable merit from a purely economic standpoint, independent of its consistency with the strictures of Islam. From a policy perspective, one can go from the analysis in the paper and argue that banks should operate two windows for deposit transactions. One window would cover only transaction balances and would pay no interest on deposits. In other words, all deposits made through this window would be akin to existing demand deposits, with one important difference. Such deposits would have a 100 percent reserve requirement placed on them, and there would be no possibility of using these deposits as a basis for multiple credit creation. The backing of these deposits could be in the form of currency, foreign exchange, or suitable government securities. The reason for adopting a 100 percent reserve requirement is that these deposits would be completely safe and thus would simultaneously satisfy the desires of risk-averse individuals and prevent the dangers of runs from interfering with the payment’s mechanism. If such deposits did not yield any return to the banks, then presumably a service charge could be levied on depositors that would correspond to the costs of administering this window.

The other window would be the profit and-loss, or equity account, in which a depositor would be treated exactly as if he were a shareholder in the bank. There would be no guarantee provided of the rate of return or of the nominal value of the share. No official reserve requirement would be necessary for these investment deposits, although presumably for prudential reasons banks would maintain some minimum level of reserves. Since deposits through the profit-and-loss window would be treated as investments (as in a mutual fund or investment trust for example), there would be no obvious reason for the government to impose legal reserve requirements. Regulations similar to those applying to public companies, such as equity-to-capital ratios, could, of course, still be imposed.

In conclusion, although the two-window scheme is, in fact, being implemented in Islamic countries, there has been no basic change in the reserve requirements of different types of deposits. To maximise the safety benefits that are inherent in the system, such a change, clearly, would seem advisable.

Edited By Asma Siddiqi

Institute Of Islamic Banking And Insurance London

Comments

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.