ISLAMIC FINANCIAL INSTRUMENTS: DEFINITION AND TYPES

ABDUL AWWAL SARKAR

Elimination of interest is one of the basic requirements for the establishment of an Islamic economic order. In recent years, a good deal of attention has been paid in finding ways and means of doing away with interest.

One important aspect of this initiative is the development of risk-return-bearing financial instruments that can provide investors as well as banks with a sufficient degree of liquidity, security and profitability to encourage them to make effective investment decisions.

Since an Islamic economy is essentially a share economy based on profit, rents and dividends, as reflected through different investment contracts, it should be possible to develop a framework of Islamic investment securities based on Musharaka, Mudaraba and Murabaha concepts and othe r mode s of Islamic financing (e.g., Bai Salam).

Since the cost of investment in securities based on these concepts is mainly a function of the rate of return. Islamic instruments can have a built-in stabilising influence on investments and they would also be less prone to speculation.

In this connection, it may be mentioned that the underlying principles of advance sale (Bai Salam), and sale on deferred payment (Bai Muazzal), etc., can possibly be operationalised in the conduct of Islamic financial markets.

A brief review of some of the existing financial instruments issued by banks, investment companies and governments are analyzed in the following paragraphs.

Definition of a Financial Instrument

A financial instrument is a certificate representing a common share in a fund for investing and making a profit, issued by the body handling this investment or the body acting on its behalf, which provides for its negotiation and conversion into liquid money when required. Islamic Modes of Finance The scope of Islamic financial instruments is quite wide. For practical reasons. Islamic financial instruments are not classified in a haphazard way merely as short-, medium- or long-term, but by the nature of the investment itself. In Mudaraba, for example, the whole deal should be liquidated for the purpose of realisation of the profits or losses.

Salam dealing is a type of contract that can be classified, by its nature, as short-term investment. On the other hand, we find that Musharaka can be treated as a long-term investment, if it is permanent, or as a medium-term investment if it takes the form of decreasing participation.

If there were an Islamic capital market, there would be no difference between short-term, medium-term and long-term investments as all these differences lose their importance when the investor can sell his share at any time, whether in the form of Mudaraba, Musharaka, Murabaha or Salam.

Practical Experience

Some of the Muslim countries like Pakistan, Iran, Malaysia, UAE, Jordan and Sudan have introduced many Islamic financial instruments in order to mobilise idle resources for long-term productive and development activities on the basis of Islamic principles. The Islamic financial instruments, which have been introduced into these countries, are different in nature and characteristics from the interest-based ones. The Modus Operandi of these financial instruments is mostly based on the Mudaraba mode of finance.

Definition of Mudaraba

Mudaraba is a form of partnership where one of the contracting parties, called the Shahib al-Maal or the Rab al-Maal (the financier), provides a specified amount of capital and acts as a sleeping partner, while the other party, called the Mudarib (entrepreneur), provides the management skills for carrying on the venture, trade, industry or service, with the objective of earning profits.

The Mudarib is in the nature of a trustee as well as an agent of the business. The Mudarib is required to work with honesty and sincerity, and to exercise the maximum possible care and precautions in the exercise of his functions. If he is guilty of wilful negligence, fraud or misrepresentation, he is himself responsible for the consequences, and the resulting loss, if any, cannot be charged to the Mudaraba account.

Mudaraba is also synonymously termed Maquaradah and Mudarib is Maqarid. In general, the Hanafi, Hanbali and Zayidi schools of Muslim Jurisprudence have used the term Mudaraba, while the Maliki and Shafi schools have preferred the term Qirad.

Pakistan

The Mudaraba certificate is one of the instruments which have already been introduced into Pakistan under the special law called “The Mudaraba companies and Mudaraba (Floatation and Control) Ordinance, 1980”.

The law was subsequently supplemented by the “Mudaraba Companies and Mudaraba Rules, 1981”. The Mudaraba law provides the necessary legal framework for the flotation of Mudarabas in Pakistan. Under this law. Management companies, banks and financial institutions can register themselves as Mudaraba companies and float a Mudaraba for a specific or general purpose.

The objects of any Mudaraba are restricted to businesses permitted under the Islamic Sharia. In order to ensure that Mudarabas are not used in any activity that is repugnant to the tenets of Islam, the prospectus of each Mudaraba needs a prior clearance from a Religious Board.

Furthermore, after the Mudaraba goes into operation, the law imposes additional responsibility on the auditors to certify that all business conducted, investments made and expenditure incurred, are in accordance with the objects, terms and conditions of the Mudaraba.

To safeguard the interest of the Mudaraba certificate-holders, a number of protective clauses have been provided, including quick and simple adjustment by a tribunal.

In order to promote the growth of Mudarabas, and keeping in view the larger interests of Mudaraba certificate-holders, the entire income of Mudaraba funds has been exempted from income tax, provided that 90 per cent of the income is distributed to the Mudaraba certificate-holders.

Types of Mudaraba

There are two types of Mudaraba existing in Pakistan:

1. Multi-purpose Mudaraba a) Mudaraba having more than one specific purpose or objective.

2. Specific Purpose Mudaraba b) Mudaraba having one specific purpose or objective.

Mudaraba Companies in Pakistan

According to a recent report, 37 Mudaraba companies have floated Mudaraba certificates of different types and maturities. The names of the Mudaraba are:

Al-Ata leasing Mudaraba; Al-Zamin leasing Mudaraba; B.F. Mudaraba; BRR Capital Mudaraba; BRR Second Mudaraba; First Allied Bank Mudaraba; First Al-Noor Mudaraba; First Crescent Mudaraba; First D.G. Mudaraba; First Elite Capital Mudaraba; First Equity Mudaraba; First General leasing Mudaraba; First Grindlays Mudaraba; First Habib Bank Mudaraba; First Habib Mudaraba; First Hajveri Mudaraba; First Mehran Mudaraba; First National Mudaraba; First Nishat Mudaraba; First Professional Mudaraba; First Providence Mudaraba; First Prudential Mudaraba; First Punjab Mudaraba; First Sanaullah Mudaraba; First Tawakkal Mudaraba; First Tri-Star Mudaraba; First UDL Mudaraba; Industrial Capital Mudaraba; LTV Capital Mudaraba; Mudaraba Al-Mali; Mudaraba Al-Tijarah; Schon Mudaraba; Second Prudential Mudaraba; Third Prudential Mudaraba; Trust Mudaraba; and Unicap Mudaraba.

Mudarabas have been playing a significant role in capital formation in Pakistan and in financing those segments of trade and industry, which are not being catered for by the banks and financial institutions.

In the wake of the low savings rate in that country, the flotation of Mudarabas have provided an opportunity to the general public to invest in Mudaraba funds which operate essentially on Islamic Sharia principles.

There has been a very enthusiastic response from the general public and we have seen the flotation of 44 Mudarabas up to June 1993 with a total capitalisation of Rs6.96 billion.

The State Bank of Pakistan has established a separate department called the ‘NBFI Department’ to regulate and monitor the operations of Mudarabas and other non-banking financial institutions and has prescribed detailed rules and regulations in this regard.

Participation Term Certificates (PTCs)

The banking and financial institutions in Pakistan have evolved a new corporate security to replace interest-based debentures. It is named Participation Term Certificates or PTC. Participation Term Certificates are transferable corporate instruments based on the principles of profit-and-loss sharing and are intended to replace debentures for medium- and long-term local currency loans for industrial and other financing.

Instead of receiving interest, as in the case with debentures, the PTC-holders share the profit or loss of the companies involved. John Harrington of Seton Hall University, New Jersey, USA has suggested that PTCs could be used as vehicles to finance the construction of public buildings to be then leased to the government. Holders of PTCs would profit from rentals paid by the government and also from the gains if the properties were sold at higher prices.

PTCs of this type would reduce the need for government debt, provide an attractive earnings asset to investors, and could be traded in the capital market. They would be eligible investments for banks, as are other PTCs.

Salient Features of PTCs:

a) The certificates are for a specified period, not exceeding ten years excluding the grace period;

b) As PTC finance is provided for a specified period, it is secured by a legal mortgage on the fixed assets of a company and a floating charge on the current assets;

c) For the purpose of allocation of profit to PTC holders, the investment ranks pari passu with equities and shares in profits on a basis to be determined by mutual agreement;

d) The share of PTC-holders in the profit is deducted prior to the claims of shareholders in the profits of the company in any given year;

e) The proceeds of the PTC are to be used exclusively for implementing the project, with the sponsors being required to give an undertaking to conduct the business with diligence and efficiency in accordance with sound engineering, financial and business practices, and on such other terms as may be agreed between the parties;

f) An option may be given to the PTC holders to convert a certain portion of their outstanding Participation Term Certificates into ordinary shares;

g) A Rights option is given to the existing ordinary stockholders to subscribe to a fresh issue of PTCs.

The Investment Corporation of Pakistan and PTCs

The Investment Corporation of Pakistan (ICP), up to 1986, had entered into arrangements for project financing on a long-term basis, against issues of PTCs, with various companies. The main points of such arrangements were as follows:

a) PTCs are secured by a mortgage of all present and future movable and immovable properties of the related projects and carry a floating charge on their current assets.

b) The PTCs are redeemable within a period of six to ten years in half-yearly instalments from the date of commencement of commercial production.

c) In terms of investments in PTCs, the corporation is entitled to a discount at the rate of 12 per cent per annum from the date of disbursement to the date of commencement of commercial production for the new projects.

Furthermore, after commencement of commercial production and for companies already in commercial production, the corporation participates in the profit of the company in the same proportion as the PTCs have with the aggregate of the amount of investment against PTCs, reserves and the paid-up capital of the company.

However, in order to provide an incentive to the company for efficient management and good performance, the Corporation retains only such amount out of their share of the profit as to yield 17 per cent of the face value of PTCs in any one accounting year If the profit shared by the corporation is paid by the company within 30 days of the close of its annual accounts, the company is entitled to a rebate at the rate of 2 per cent and the corporation retains an amount equivalent to 15 per cent of the face value of the PTCs out of their share of the profit in any one accounting year.

d) If a company makes a loss, the corporation shares the loss in the same proportion as its respective PTCs have with the equity of the company. However, losses accruing in any one accounting year will first be adjusted against the existing reserves, if any. Further, in terms of the agreement, a company will issue convertible shares in favour of the corporation of the equivalent amount of the loss incurred. Such convertible shares will be entitled to a dividend at the same rate and in the same manner as is available to ordinary shareholders.

Term Finance Certificates (TFC)

TFCs are part of the non-participatory, redeemable capital based on buy-back and mark-up. It is the most criticised instrument of financing currently being used by the banks and DFLs in Pakistan.

This mode has neither been recommended by the SBP nor has it any legal basis. It was introduced by a DFI in 1984-85 and afterwards became a major mode of term finance in place of PTCs.

The borrowing company sells the item that it had agreed to purchase as a consequence of a paper deal with the firm supplying the item, to the financing institution for a certain ‘sale price’ and then purchases back the same from the financing institution for a sum called the ‘purchase price’, which is paid in instalments in accordance with the redemption dates of the TFCs issued by the borrower company.

If TFCs are not redeemed on the due date, the borrower is required to pay to the holder of such TFCs’ an amount equivalent to 20 per cent of the TFCs’ face value.

ICP and TFCs’ (Long/ Medium-term)

The corporation has made investments in term finance certificates issued by various companies. The salient features of this mode of investment are:

a) This involves purchase from and resale of investment properties to companies financed by the ICP.

b) The TFCs are secured by a mortgage/charge on all the present and future movable and immovable properties and a floating charge on the current assets of the project. In addition, the borrower commits himself to providing the corporation with such further securities and guarantees as it may from time to time, or at any time require.

c) Under the agreement, the Corporation is entitled to a mark-up of 22 per cent per annum and, in the case of payment on the due date, the following rebates are allowed: loans sanctioned before 3 October, 1988 – rebate rate of 7 per cent; loans sanctioned between 3 October to 16 December, 1990 – rebate rate of 6 per cent; loans sanctioned from 16 December, 1990 onwards – rebate rate of 5.575 per cent.

d) The payment period generally ranges from twelve to sixteen equal half-yearly instalments starting after six months of the commencement of commercial operations.

Foreign Exchange Certificates of Investment

The Al-Faysal Investment Bank Ltd of Pakistan has introduced Foreign Exchange Certificates of Investment. Th e special features of this certificate are as follows:

a) Higher returns than International Market.

b) The TFCs are secured by a mortgage/charge on all the present and future movable and immovable properties and a floating charge on the current assets of the project. In addition, the borrower commits himself to providing the corporation with such further securities and guarantees as it may from time to time, or at any time require.

c) Under the agreement, the Corporation is entitled to a mark-up of 22 per cent per annum and, in the case of payment on the due date, the following rebates are allowed: loans sanctioned before 3 October, 1988 – rebate rate of 7 per cent; loans sanctioned between 3 October to 16 December, 1990 – rebate rate of 6 per cent; loans sanctioned from 16 December, 1990 onwards – rebate rate of 5.575 per cent.

d) The payment period generally ranges from twelve to sixteen equal half-yearly instalments starting after six months of the commencement of commercial operations.

Foreign Exchange Certificates of Investment

The Al-Faysal Investment Bank Ltd of Pakistan has introduced Foreign Exchange Certificates of Investment. The special features of this certificate are as follows:

a) Higher returns than International Market.

b) No Zakat, withholding or wealth tax.

c) No restrictions on world-wide remittance.

d) Financing facility in Pakistani Rupees is available against investment.

e) Maturities ranging from three months to three years.

f) Choice of investments in pounds sterling, yen, US dollars or Deutsch marks.

Jordan

The Islamic Development Bank (IDB) generally encourages its member countries to adopt Islamic techniques in the financing and development of projects. In response to this, the Hashemite Kingdom of Jordan promulgated the Muqarada Bonds Act in 1981. The Jordanian Ministry of Awkaf adopted this technique to finance a project to set up a commercial centre (commercial shops, offices, car parks, etc.).

Salient Features

Muqarada bonds, as the term denotes, are based on the conclusion of a lawful Muqarada (the Mudaraba) with provision of capital on the one hand and labour on the other and the shares of the profit are determined beforehand as a definite proportion of the total. The main purpose underlying the issuance of Muqarada bonds is the financing of a given project with the object of executing the project, utilising it and making a profit.

As an incentive to the subscriber to the Muqarada bonds. Article 10 of the Law stipulates that profits realised from investment in Muqarada bonds are not subject to income tax. The Government guarantees the principal amount of the bonds. Article 18 of the law also authorises dealing with Muqarada bonds on the Amman Stock Market according to its rules and regulations. It also permits the transfer of ownership of the bonds in accordance with these rules.

Malaysia

The Malaysian Government promulgated the Government Investment Act 1983 (Laws of Malaysia Act, 275). Under this Act, the Government has introduced investment certificates, which are Mudaraba bonds. The Government invests the funds generated by these certificates in profitable projects and distributes profit among the certificate holders annually.

Government Investment Certificates (GICs) are issued under the concept of Qard-Al-Hasana, whereby the lender lends to the Government a principal sum of money and the Government may, at its discretion, give a return or dividend on this to the lender.

The issuance of GICs is governed by the Government Investment Act 1983. Under this Act, the Government is allowed to borrow up to RM 3.0 billion to finance its deficit through the issuance of GICs. At present, the total outstanding issue of GICs is RM 4.8 billion and it comprises 6.5 per cent of the total Government domestic debt.

The dividend rate declared by the Government (if any) will be paid to the holders of GICs on an annual basis on every anniversary date or on the maturity date (i.e., in cases where the tenure of the issue is one year) The dividend rate is determined by the Dividend Committee, which comprises representatives from the Treasury Office, the Bank Negara Malaysia, the Economic Planning Unit and the Islamic Centre.

The factors that are normally taken into consideration in deciding the dividend rate are the country’s economic performance, the inflation rate and the equivalent return on other Government instruments, etc.

Government Investment Certificates are qualified securities for the purpose of complying with the liquid assets requirement to be maintained by financial institutions. With regard to this, the Bank Negara provides the discount window facility for financial institutions to buy or sell GICs with Bank Negara. The trading of the Government Investment Certificate will be based on the Expected Dividend Rate and the formula for the price computation is as follows:

Price =

((a X b) + I X 100)/ 36500

where a = Expected Dividend Rate and b

= Number of days from the issue date or last dividend date to the value date of the transaction.

For example: if the Expected Dividend Rate of a 1-year GIC is 6 per cent per annum and the issue date of this GIC was on 30 June, 1994 and it was transacted on 2 December, 1994, the price will be computed as follows:

Price =

((6 X 155) + 1 X 100)/ 36500

= 102.55

If the investor purchased a GIC of RM I million, the amount of the proceeds to be settled would be RM 1,025,500.00.

Note: that the Expected Dividend Rate is reviewed on a monthly basis.

Government Investment Certificates are used by the Government to finance its deficit as an alternative to the issuance of Malaysian Government Securities (which are interestbearing instruments) and Malaysian Treasury Bills.

At present GICs are playing an important role in developing the Islamic Banking Scheme of Malaysia, whereby Islamic Financial Institutions will be able to park their cash surpluses and enhance their return on their investments.

Iran

Around September 1994, the Tehran Municipality, Iran, issued a bond named ‘Participation Bond’, in accordance with Islamic principles, for financing the reconstruction of the Navab Highway. The essential features of the bond are as follows:

a) Participation Bonds are issued in accordance with Islamic Principles and on the basis of investment in economic projects with a positive rate of return. The return is divided between the investors and the issuer of the bonds, who is also responsible for the completion of the project.

b) Participation Bonds can be issued by both the public and the private sectors.

c) In each case, there is an underwriter who accepts the flotation of the bonds and purchases those bonds not purchased by the general public.

d) For each case, the issuer should guarantee a minimum amount of profit from the related project. Profits over and above the guaranteed level are distributed after the completion of the project. If the projected minimum profit is not realised, the entire responsibility for the provision of funds for the payment of the guaranteed return falls on the issuer.

e) The bonds are issued for the purpose of financing a specific project and cannot be used otherwise.

f) The bonds are issued together with special coupons for the collection of returns. The due dates of such coupons are specified at the time of the issue.

g) Such bonds are issued without a holder’s name and on a bearer basis.

h) The bonds are negotiable and can be transacted through the Tehran Stock Exchange.

i) In the case of Participation Bonds issued by the Tehran Municipality, the specific details are as follows:

1 The maximum amount to be issued is Rls 250 billion in four consecutive series.

2 Bank Melli is the underwriter and, hence, the agent responsible for floating this bond.

3 All bonds issued during the first round were sold at the time of issue. So far there have been no secondary dealings on the Tehran Stock Exchange.

4 As the profits are paid through coupons, the face value is identical to the redemption value.

5 The expected rate of return on the project is checked by the authorities of Bank Melli. The auditor has approved a rate of profit of around 25 per cent.

6 The Municipality has signed a contract with Bank Melli authorising the bank to pay a minimum guarantee interest of 20 per cent.

Bahrain

The Islamic Investment Company of the Gulf (IICG) (a member of the Dar Al-Maal Al-Islami Group), that is the first Islamic Investment Company in the world, has introduced many Mudaraba instruments. In the financial mechanism, the IICG acts as the Mudarib, i.e., the managing trustee, on behalf of the investors and accordingly, invests in Riba-free profitable projects in a bid to share the accruing profits as per the ratios agreed upon in the Mudaraba contract.

The Mudarabas introduced by the IICG can be grouped as follows:

a) Current Investment Accounts:

1. The Fourth Islamic Mudaraba for Current Investment:

The subscription in this Mudaraba is effective from the date of receiving the investment fund, through buying the Mudaraba portions according to their posted value.

The Mudaraba funds are operated and managed in weekly cycles governed by a computerised system to compute expenses and allocate profits.

The investment participant may redeem all or part of his/her funds within a week of submitting an application for a refund.

Profits are distributed on a weekly basis: 90 per cent to the investors (equity owners)) and 10 per cent to the Mudarib (managing trustee), namely, the Islamic Investment Company of the Gulf (IICG).

2. The Islamic Mudaraba for Current Investment (Bahrain):

Through buying the Mudaraba portion according to its posted value at the date of receiving investment funds.

The Mudaraba funds are operated and managed in a weekly cycle governed by a computerised system to compute expenses and allocate profits.

The proceeds of the profit are distributed, on a weekly basis; 75 per cent to the investors and 25 per cent to the company.

A subscription to this Mudaraba is free from any issuance fee.

The investor may redeem all or part of his/her equity within a week of submitting a request to this effect.

b) Investment Accounts on Fixed Terms:

1. The Islamic Mudaraba for Financial Institutions/Individuals

This Mudaraba allows the distribution of profits on a monthly or quarterly basis to investors in addition to offering them the following benefits and privileges:

Short-term investment opportunities for financial institutions and businessmen.

The profits at the maturity of each period (monthly or quarterly) are distributed as follows:

i) 4/5 (four-fifths) to the participants in this Mudaraba

ii) 1/5 (one-fifth) to the company which is entrusted with managing the assets

The Mudaraba contract allows for opening L/Cs and L/Gs against regular fees while the investors continue to be eligible for profits.

The participant may redeem his/her funds, in whole or in part, by submitting a written demand to any of the company’s offices upon the expiry of the maturity of the Mudaraba contract (monthly or quarterly). His/her money will be repaid to him/her within three days from the beginning of the next valuation data.

2. The Islamic Mudaraba for Private Investment

The investor (Rab Al-Maal) in this Mudaraba delegates the Islamic Investment Company of the Gulf to invest his/her funds according to the provisions of the Sharia, and under the supervision of the Religious Supervisory Board, and as per his/her investment instructions regarding risk-taking (low, medium or high risk).

The duration of the investment may be one, three or six months or one year. Pursuant to the investor’s desire, the IICG manages every individual account independently to the best advantage of the investor.

Profit is distributed in the following manner: the investor and company receive 80 per cent & 20 per cent respectively for low-risk transactions; 75 per cent & 25 per cent for medium risk; and 70 per cent & 30 per cent for high risk.

3. The New Islamic Mudaraba for Private Investment Portfolios

This Mudaraba is a partnership between the Mudarib (IICG) and the Mudaraba certificate holders (Rab Al-Maal). The minimum investment is one million US dollars or the equivalent in other currencies. The Mudaraba funds are invested according to the Islamic Sharia provisions.

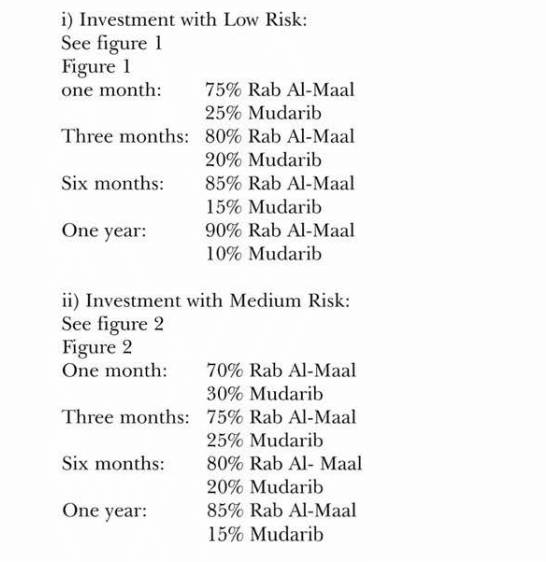

The investor may specify his/her funds to be invested in low or medium risk Islamic investments.

The participant can withdraw by submitting a written request to the Mudarib, not less than seven working days from the Mudaraba’s maturity date. Profit is distributed as follows:

4. The Islamic Mudaraba Renewable Investment

The object of this Mudaraba contract is to provide the opportunity for the collective investment of the funds of the participants in this Mudaraba within the framework of the principles of the Islamic Sharia.

The funds of this Mudaraba are invested in ail areas permissible under the Islamic Sharia and according to the Mudaraba contract. The investments begin seven days after receiving the subscribed funds.

The minimum amount of the subscription is US$70,000 or its equivalent for a one month to three months investment period and a minimum of US$50,000 or its equivalent for a six-months to one-year investment period.

The investor may redeem the value of his/her certificates, including profits, if any, on the third business day following the end of the maturity date.

5. The Real Estate Investment Mudaraba

The object of this Mudaraba is collective investment in real estate properties, on a panIslamic and international basis, in Muslim and other countries. The minimum amount is US $25,000 or other equivalent currency. The participant may redeem Mudaraba units owned for at least twenty-four months in whole or in any part from liquid assets. Profit is distributed as follows: 70 per cent for the participants; 30 per cent for the manager (IICG).

c) Investment Accounts (Current & Term Investments):

1. The Seventh Islamic Mudaraba for Investment, Savings and Takafol (Islamic alternative to insurance)

This Mudaraba is the Islamic alternative to conventional life insurance, which is not acceptable to the Islamic Sharia as it involves Riba (usury), Gharar (uncertainty) and gambling.

This Mudaraba offers the subscribers the benefit of investing and, at the same time, saving their instalments together with the accumulated profits. It also has another privilege, which is Takafol, in that part of the accrued profits of the subscribers may be designated by them in favour of the family of any participant who may die during the time of his/her participation.

Eligibility for this Mudaraba is restricted to Muslims, males or females, who belong to the age group 20 to 56 years. A male is entitled to buy a maximum of four certificates while a female is entitled to buy only two.

The participant pays an annual instalment on the value of the certificate, plus 3 per cent issuance fee. The total value of the certificate is sub-divided by the number of years that remain before the participant reaches the age of sixty, rounding up the amount to the nearest figure.

A schedule showing the age and number of premiums and the value of the annual premium and the acceptable currencies is jointly worked out to serve the purpose. The participant accordingly continues to pay the premiums until he/she reaches the age of 60.

The participant is eligible to withdraw, but not before the termination of the second year of his/her membership; only then shall the Company pay him back 95 per cent of the amount due (instalments & profit).

The participant enjoys the privilege of Takafol upon completion of his/her first year of membership, provided that he/she is regularly paying his/her premiums. In case of his/her death, the company shall reimburse the legal and authorised heirs all paid up premiums and their due profits, plus the premiums the deceased would have paid until the age of 60 in Takaful from the profits of the other participants.

A set of legal conditions is incorporated in the Mudaraba contract by virtue of which the participant is deprived of the privilege of Takaful if he/she fails to abide by them.

If the participant continues to pay all the instalments due until he/she reaches the age of 60, he/she is entitled to recover them all, plus the accumulated profits.

Investment dividend is shared at the ratio of I/IO to the company and 9/10 to the participants.

2. The Development Mudaraba for Egypt

The objectives and main features of the Development Mudaraba for Egypt are as follows:

Contributing to the performance of economic and social development by investing in the fields of agriculture and industrial and commercial enterprises.

Providing the opportunity for collective investment of the funds of the participants in this Mudaraba within the framework of the principles of the Islamic Sharia.

Benefiting by the economic circumstances and the expected growth rates.

i) Profits shall be distributed as follows: Owner of the M Certificates 70 per cent, Mudarib 30 per cent.

ii) The investor may redeem the funds owned by him upon written request to the manager not less than seven working days before the date the funds are required by the investors. The maximum amount may be redeemed after two years.

iii) The participant undertakes to pay, personally and from his own funds, every year, the Zakat due on the Mudaraba together with the Zakat due on his other assets, according to the Sharia.

Islamic Development Bank (IDB) Unit Investment Fund

The IDB Unit Investment Fund was launched in December, 1989 and marked the beginning of the implementation of a major bank policy.

This policy was designed to generate additional resources for the bank on a basis compatible with the Sharia. The fund is a US dollar-dominated investment fund to be managed by the IDB in accordance with the Islamic concept of Mudaraba, with the IDB undertaking the role of Mudarib.

The Fund will invest in a range of viable ventures in IDB member countries. Until such time as the issue of investment in equities is financially resolved by the Islamic Fiqh Academy of the OIC, all the investments of the fund are being made in lease and instalment-scale financing, with the bulk of the investments being concentrated in lease financing.

The IDB Unit Investment Fund is expected to facilitate the bank’s efforts to mobilise resources by purchasing some of its medium and long-term investments, thus providing the bank with resources to reinvest in other ventures.

Switzerland

A prominent member of the Dar Al-Maal Al-Islami Group, Faisal Finance (Switzerland) SA has issued Islamic securities as one of the instruments in its financial packages.

It is evident from the above that though it was little, the Muslim theoreticians and practitioners have helped to develop these instruments. They have proved to be effective instruments for investment-related financing. To meet the changing environment of financial markets, some Muslim economists have suggested the devising of new types of financial instruments. Dr M A Hannan of IDB has suggested 10 broad variables for new financial instruments, such as:

1. Loan Certificates

2. Index Linked loan Certificates

3. Islamic Commercial Paper

4. Integrated Investment Bonds

5. Profit-Sharing Certificates

6. Expected Rate of Dividend Certificates

7. Rent-Sharing Certificates

8. Firm-Commitment Certificates

9. Zakat Certificates

10. Human Capital Certificates

Another economist of IDB, Mohammad El-Hennawi, has suggested two types of certificates, which will provide stability of resources to the Islamic banks and enhance their development role. The suggested instruments are:

Islamic Certificate of Deposit (ICD) and Islamic Investment Certificates (assigned to a particular project or a group of projects).

The Islamic Research and Training Institute (IRTI) of IDB is also continuing its efforts to develop new types of financial instruments, compatible with the Sharia, which would enable it to increase its own resources in order to meet the growing needs of its member countries for financing.

To this end, the IRTI in 1991 announced its willingness to provide financial assistance to Muslim economists and researchers to write research papers on the development of appropriate Islamic financial instruments for foreign resource mobilisation.

The suggested Islamic financial instruments are: Net Income-Sharing Instruments; Gross Income-Sharing Instruments; Sale based Instruments; Commodity-linked Bonds; Indexed Bonds; and Equity Bonds.

Conclusion

In conclusion, it may be said that considering the important role of financial instruments in the mobilization of financial resources, scholars and bankers will have to work in tandem, with vision, courage, imagination and, above all, absolute conviction and commitment to the cause of Islam, to examine the future prospects and possibilities of diversifying and widening the scope, volume and size of Islamic financial instruments.

Edited By Asma Siddiqi

Institute Of Islamic Banking And Insurance London

Comments

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.