ACCOUNTING SYSTEMS FOR ISLAMIC BANKING – AN INSIDER’S PERSPECTIVE

MUSA A SHIHADEH

Introduction

Banks play an active and essential role in the development of modern economies. Accordingly, some Islamic countries have taken steps towards the comprehensive application of the principles of the Sharia in banking. Muslims started to look for an Islamic form of banking which would operate on a non-usurious basis.

Muslims firmly believe that the principles of Islamic economy were revealed by God and that the ultimate purpose of Islamic economy is to maintain the welfare and happiness of human societies.

Islam, like all other divine religions, prohibits usury because of the negative effect that usury has on the social and economic behaviour of individuals and groups.

Therefore, the mission of Islamic banks is multi-fold. They must perform their activities on a non-usurious basis and at the same time prove that a proper combination between capital and labour can achieve remarkable success in the progress of their respective national economies.

Activities of Islamic Banks

I shall try to give an idea of the activities of the Jordan Islamic Bank, which in essence correspond to most of the activities of other Islamic banks.

Objectives

The bank aims at meeting economic and social needs in the field of banking services, financing and investment operations on a non-usurious basis. These objectives include:

1. Expanding the extent of the banking sector by offering non-usurious banking services, with special emphasis on introducing services designed to revive various forms of collective responsibility on a basis of mutual benefit.

2. Developing means to attract funds and savings, and channelling them into non-usurious investment.

3. Providing the necessary financing to meet the requirements of the various sectors of the economy, particularly those that are not likely to benefit from usurious banking facilities.

Functions

In order to realise its objectives, the Bank carries out, on a non-usurious basis, such operations in the following fields of banking services as will enable it to attain such objectives.

1. Accepting Deposits

Such deposits include the following:

a) Trust deposits. Deposits received by the Bank from persons where the bank is authorised to use the deposits at its own risk and responsibility in respect of profit or loss, and which are not subject to any conditions for drawing or depositing.

b) Joint investment accounts. These include deposits received by the Bank from persons desiring too participate in multilateral and continuous investment financing operations, whereby such deposits will receive a certain percentage of the annual net profit realised in accordance with the conditions of the account under which they are entered.

c) Specified investment accounts. Deposits received by the Bank from persons desiring to appoint the Bank as agent for investment of these deposits in a specific project or in a specific manner, on the basis that the bank will receive a part of the net profits realised, but without liability for any loss which is not attributable to any violation or fault by the bank.

d) Muqarada bonds. These are documents having a uniform value, issued by the Bank in the names of the persons who subscribe therein by paying their face value, on the basis of participation by the holders of these bonds in the annual profits realised in accordance with the terms of each separate issue of such bonds.

2. Finance and Investment Activities

The Bank performs all sorts of finance and investment activities organised on a nonusurious basis. These include:

a) Mudaraba. Advances by the Bank of the necessary funds, fully or partially, for financing a specific operation administered by another person on the basis of participation in the profit or loss from such operation.

b) Participation, which can be divided into:

(i) Decreasing participation

Participation by the Bank as a financing partner, fully or partially, in a profitable project on the basis of agreement by the other partner that the Bank will receive a certain part of the net profit actually realised, while the partner is entitled to retain the remaining part, or any part thereof, as may be agreed upon, to be off-set against the funds advanced by the Bank for financing the project.

(ii) Continued Participation. Where the Bank holds a share in the equity of a project that is expected to gain a return, it continues to be a partner.

c) Purchasing for others on a pre-agreed profit basis. Implementation by the Bank of an agreement where by the Bank purchases on behalf of the other contracting party goods requested by the said party, and pays the purchase price in full or in part, on the basis of an undertaking by the contracting party to re-purchase the same goods at a profit agreed upon in advance.

3. Other Non-Usurious Banking Operations

The Bank carries out, whether for its own account or for the account of others, such traditional or modern banking activities as it is able to undertake within the limits of its commitment, including:

a) Accepting deposits and opening current and other accounts of various types, as mentioned earlier. Payment and clearance of cheques. Collection of bills of exchange, transfer of funds, opening of documentary credits, issue of bank guarantees, and other banking services.

b) Dealing in the purchase and sale of foreign currencies on the basis of spot rates only. It is permissible, in this regard, to undertake mutual lending in various currencies without interest as may be required.

c) Giving fixed term loans as a mere service without interest.

d) Management of properties and other assets, which can be managed by the bank on the basis of an agency fee.

e) Acting as a trustee

f) Carrying out feasibility studies and giving information and consultancy services on various economic matters.

4. Social Services

The Bank acts as a trustee in organising social services designed to strengthen the ties of solidarity and co-operation among various groups and individuals, through the following activities:

a) Giving beneficial loans for productive purposes in various fields to enable the beneficiaries to start independent lives or to raise their incomes and standard of living.

b) Establishment and administration of special funds for various social purposes.

c) Any other activities within the scope of these general objectives.

In short, Islamic banking is interest-free banking, elaborating the possible ways of reorganising banking without the institution of interest. Islamic banks offer to those who want to avoid interest the mechanism needed through which savings are channelled from savers to investors on the basis of a profit-sharing system. They function as financial intermediaries between savers and the ultimate users of funds, where the savers share the risk of low return or even loss.

Accounting Systems of Islamic Banks

In regard to the accounting system of the Jordan Islamic Bank, it is worth pointing out that the Articles which govern this system, as stated in the Bank’s Law, are explained and/or detailed by the Bank’s Board and management, and that these explanations are subject to the approval of the Bank’s Sharia consultant, who must, in turn, elaborate the Sharia standpoint on these explanations. Below are some extracts from the Bank’s law.

ARTICLE FOUR: Profits Realised from Investments

SECTION 18

Profits and losses relating to financing and joint investment activities shall be separated in the accounts from the other income and expenditure relating to other activities and services offered by the Bank. Th e same applies to the income and expenditure of investments for specific purposes, in respect of which a separate account must be kept for each particular project.

SECTION 19

In accounting for the profit income connected with its financing and investment activities, the Bank may not adopt a method of accounting which takes into account estimated or expected profits, but it must confine itself to the profits realised in accordance with the nature of the operations which the bank finances, and in accordance with the following rules:

a) In the case of individual Mudaraba, the profits shall be realised on the basis of a final settlement of accounts carried out between the Bank and the party utilising the funds. Such settlement should be based on actual receipt of the cash and realisation of the income and should be duly approved and accepted. The profits of each year shall be entered in the accounts of the year in which such settlement is carried, whether in respect of the complete project or a part of it.

b) In the case of decreasing participation, the profit or income shall be realised on the basis of the net income derived from the project concerned until the end of the financial year, even if such income is not in fact received in cash, as in such event, the income realised shall be treated as money due but not received.

c) In the case of purchasing for others on a pre-agreed profit basis, the profit shall be realised upon the conclusion of the subsequent contract and on the basis of the difference between the actual cost and the price agreed upon with the party who ordered the purchase.

d) The various financing operations shall be charged with all the direct expenses and costs arising therefrom, and should not be charged with any part of the general overhead expenses of the Bank.

The Apportionment of Joint Investment

SECTION 20

a) In order to replenish the special account for meeting investment risks, the Bank shall deduct annually an amount equal to ten per cent of the net profits realised from various investment operations during that year.

b) The amounts so deducted annually shall be kept in a special account to meet any losses exceeding the total profits derived from investment in that year.

c) The deduction of such percentage should be stopped as soon as the accumulative balance of this account reaches twice the paid-up capital of the Bank.

SECTION 21

Distribution of Profits Between the Bank and the Investors:

a) The Board shall announce by public notice the general percentage of the profit to be allocated to the general funds participating in joint investments, such announcement to me made at the beginning of the same financial year and no later than the end of the first month of every year.

b) The Bank as joint venturer shall be entitled to the remaining percentage after the deduction of the amount allocated to the investors. The Bank shall also be entitled to participate in the profits of joint investments in proportion to the amount of its own funds or the funds which it is authorised to risk in joint investments.

(c) In determining the funds participating in joint investment, priority shall be given to joint investment deposits and to the holders of joint Muqarada bonds. The Bank may not consider itself as a participant in financing from its own funds save to the extent of the excess of the amounts utilised in financing over the total balances of the investors.

SECTION 22

a) The Bank, as a joint venturer, shall bear any losses resulting from any cause for which it is legally liable, including any cases where authority is exceeded or insufficient care or caution is exercised by the members of the Board of Directors, or the managers or employees or workers of the Bank. Insufficient exercise of care for which the Bank is answerable shall include any cases of fraud, abuse of trust, collusion, and similar forms of misconduct which fall short of the standards of honesty expected in the management of joint venture operations by the Bank.

b) Losses incurred which are not attributable to misconduct involving the exceeding of authority or failure to exercise care or caution shall be deducted from the total profits realised for the year in which such losses are incurred. Any excess of losses over the profits that were actually realised during that year shall be deducted from the reserve account opened for covering the risks of investment.

c) If the total profits realised in the year, together with the reserves accumulated from the previous year, are not sufficient to cover the losses incurred, the Bank must carry out a comprehensive assessment of expected profits and losses, based on market rates, from operations which are financed by venture funds and which have not reached the stage of final settlement by the end of the financial year.

d) If the result of such assessment indicates that the estimated profits are sufficient to cover the excess loss, the Bank must carry forward the excess loss so that it may be covered from the proceeds of the expected profits as and when they are realised from the operations included in the comprehensive assessment.

e) If, on the other hand, the estimated profits are less than the excess loss, the Bank may treat it as a loss carried forward, provided that the amounts withdrawn from the joint investment deposits and the joint Muqarada bonds shall be charged with a pro-rata part of the excess loss in proportion to the percentage of participation of the amount withdrawn in the investment operations, and depending on the type of the account in each case.

SECTION 23

The Islamic legal consultant who is appointed in accordance with the provisions of this law shall ascertain the existence of a legal doctrinal (fiqh) basis to support the charging of any loss resulting from joint investment operations to the Bank.

SECTION 24

In case of liquidation of the Bank, the depositors’ rights shall be dealt with as follows:

a) The rights of depositors in trust deposit accounts, and other deposited funds which are not intended for investment and participation in investment profits, shall be settled first.

b) Next, the rights of depositors in joint investment accounts shall be settled in accordance with the special conditions applicable to such accounts, as well as shall the rights of the holders of joint Muqarada bonds, who shall receive the same percentage as the depositors in joint investment accounts.

c) Th e rights of depositors in specific investment accounts, and of the holders of specific Muqarada bonds, shall be linked to the projects specified for each investment, and they shall bear the risk of such specific investment.

d) The rights of shareholders shall be settled on the basis of a distribution among them of the remaining fund, in proportion to the shares held by each of them,

e) Th e balance of the reserve account for covering investment risks shall be transferred, upon the liquidation of the Bank, to the account of the charity (Zakat) fund to be spent for the purposes prescribed under the special law of the aforesaid fund.

Final Accounts, Balance Sheet, and Profit and Loss Accounts

SECTION 29

The accounts of the Bank are maintained in accordance with banking accountancy methods. Th e final accounts shall be closed annually on the thirty- first day of December of every year.

SECTION 30

The annual balance sheet and profit-and-loss accounts are audited annually, prior to their presentation to the General Meeting, by the auditors who are elected in accordance with the provisions of the Articles of Association.

SECTION 31

The investment profits are distributed to investment depositors and holders of Muquarada bonds from the special accounts relating thereto during the month of January of the following financial year.

SECTION 32

The net profits accruing to the Bank which are realised until the end of the financing year shall be apportioned as follows:

a) Ten per cent to the compulsory reserve account, until the balance accumulated becomes equal to the capital of the Bank.

b) Five per cent to the remuneration of the members of the Board of Directors accounts, to be distributed among them in proportion to the number of meetings within the limit prescribed by the Companies’ Law.

d) Any percentage the Board may deem necessary to provide suitable reserve to meet the various liabilities within a maximum limit of twenty per cent of the net profits of that year.

e) The balance of the profits is distributed to the shareholders in proportion to the number of shares which each of them holds.

General Notes

As previously indicated in Section 29, the Jordan Islamic Bank’s accounts are kept according to banking accounting standards. Yet, when we compare these standards with the applications used in the Jordan Islamic Bank, we notice that some of the Jordan Islamic Bank’s practices coincide with international standards while others do not. Some of these differences are explained hereunder.

Revenues Versus Interest

In traditional banks, interest rates and commissions are calculated according to value date, taking into consideration suspended interest deducted from doubtful or overdrawn accounts.

In comparison, Islamic banks do not deal in interest. If we look at investment revenues in Islamic banks and the way these revenues are treated, we will notice that they are recorded, as previously mentioned, according to accounting rules which are different from those maintained by traditional banks.

Our Bank’s special law, however, sets the rules for how to record those revenues, how to verify them and how to distribute them among depositors, shareholders and investment risk provision.

Securities

According to International Accounting Standard No. 30, securities for trading purposes and securities for long-term investment accounts are kept in separate accounts. And the difference between cost and market prices is taken as a provision against the decline of the prices of securities.

Investments in securities in the books of the Jordan Islamic Bank appear in Financing and Investment Accounts under Other Investments. No special provision is made for these investments, as they are treated like all the other investments of the bank. As I previously mentioned, a fixed percentage of 10% is taken on all investments as investment risk provision.

According to the Bank’s law, revenues or losses realised from securities are recorded after the sale thereof has been actually completed, and dividends are affected when such profits have been actually collected (on a cash basis).

Real Estate

Entries of real estate are determined according to the sources of the funds used for purchasing them. The purchase decision must indicate whether the funds used are from investment funds or from shareholders in order to decide where rents, revenues or losses must be entered.

Real estate constructed from shareholders’ funds is depreciated annually according to traditional standards, while investments in real estate of investment deposits are not depreciated.

Revenue from Banking Services

Revenues from banking services are separated from investment revenues, as the former belongs to the shareholders.

Investment Risk Provision

Investment risk provision as previously explained, belongs neither to shareholders nor to depositors, as this provision is used to extinguish loss incurring from investments, in any financial year, if these losses exceed the profits realised in that same year.

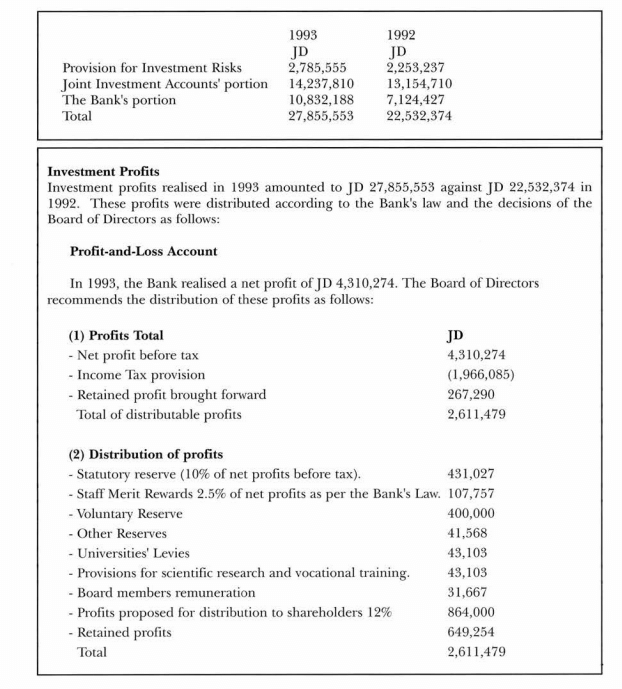

Below, I give an example of Investment Revenues Distribution, Profit-and-Loss Accounts and Profits Distribution, which illustrates how these operations are carried out at the Jordan Islamic Bank, and I conclude by giving profit-and-loss accounts of shareholders and its distribution and by giving a sample of the auditors’ comments on our accounting policies from their statement on our accounts.

Main Accounting Policies

a) In all of its transactions, the Bank adheres to the accounting principles of its special aw, which conforms to the provisions of the Islamic Sharia.

b) Shares and real estate investments are recorded at cost. Profits and losses thereof are recorded in accordance with the provisions of the law of the Bank whenever they actually occur.

c) Assets and liabilities in foreign currencies are evaluated, for balance sheet proposes, at the middle rate of buying and selling thereof, as issued by the Central Bank at balance sheet date. The difference is entered to the profit-and-loss account.

d) Fixed assets are recorded at cost, but are annually depreciated according to the fixed ratios specified by the Income Tax Department.

e) Forms provided by the Central Bank are used for classifying and illustrating the financial statements.

Conclusion

As we have seen, the accounting system of the Jordan Islamic Bank and, to my knowledge, the accounting systems of other Islamic banks correspond with the conventional accounting system in some general aspects, but differ in certain applications which are particular to Islamic banks.

This specialty of the Islamic accounting system has forced Islamic bankers to seek a model accounting system which accommodates the requirements of banking and at the same time complies with the provisions of the Sharia. To pursue this purpose, a committee was formed in 1987.

Edited By Asma Siddiqi

Institute Of Islamic Banking And Insurance London

Comments

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

23/3/2019Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.